Trump unveils fresh tariff barrage targeting branded drugs, autos, and furniture imports, reviving trade war

President Donald Trump on Thursday unveiled a fresh round of punishing tariffs on a broad range of imported goods, including 100% duties on branded drugs and 25% levies on heavy-duty trucks, set to come into force next week.

The latest salvo, which Trump said was to protect the US manufacturing industry and national security, follows sweeping duties on trading partners of up to 50% and other targeted levies on imported products such as steel.

The barrage has cast a pall over global growth and paralyzed business decision-making around the world, while the Federal Reserve has said it is also contributing to higher consumer prices in America.

Trump’s latest announcements on Truth Social did not mention whether the new levies would stack on top of existing national tariffs. But recently struck trade deals with Japan, the EU, and the United Kingdom include provisions that cap tariffs for specific products like pharmaceuticals.

Tokyo said it was still analyzing the potential impact of the new measures, which Canberra called “unfair” and “unjustified”.

Trump also followed through on a pledge to “bring back” America’s furniture business, saying he would start charging a 50% tariff on imported kitchen cabinets and bathroom vanities and a 30% tariff on upholstered furniture. All the new duties take effect from October 1.

“The reason for this is the large scale ‘FLOODING’ of these products into the United States by other outside countries,” Trump said.

Stocks of pharmaceutical companies across Asia fell as investors reacted to the news, with Australia’s CSL hitting a six-year low, Japan’s Sumitomo Pharma4506.T tumbling more than 3% and pharmaceutical indices in Hong Kong and India down more than 1%.

An index tracking Chinese-listed furniture makers also dropped around 1%.

The new actions are seen as part of the Trump administration’s shift to better-established legal authorities for its tariff actions, given the risks associated with a case before the Supreme Court on the legality of his sweeping global tariffs.

The new 100% tariff on any branded or patented pharmaceutical product will apply to all imports unless the company has already broken ground on building a manufacturing plant in the United States, Trump said.

The Pharmaceutical Research and Manufacturers of America, an industry group, said companies “continue to announce hundreds of billions in new U.S. investments. Tariffs risk those plans.”

The Trump administration has opened a dozen probes into the national security ramifications of imports of wind turbines, airplanes, semiconductors, polysilicon, copper, timber and lumber and critical minerals to form the basis of new tariffs.

Trump this week announced new probes into personal protective equipment, medical items, robotics and industrial machinery. He previously imposed national security tariffs on steel and aluminum and derivatives, light-duty autos and parts, and copper.

FOREIGN POLICY TOOL

Trump has made the levies a key foreign policy tool, using them to renegotiate trade deals, extract concessions and exert political pressure on other countries.

His administration has played down the impact on consumer prices and touted tariffs as a significant revenue source, with Treasury Secretary Scott Bessent saying Washington could collect $300 billion by the end of the year.

Some economies that have already struck deals may get a reprieve on the latest duties.

The EU’s deal with the U.S. stipulates it will pay a 15% tariff on goods including pharmaceuticals, while Japan has an agreement that its tariff rates will not exceed others including the EU, Tokyo’s trade negotiator Ryosei Akazawa said on Friday.

A timeline of Trump’s trade war

February 1 – Trump imposes 25% tariffs on Mexican and most Canadian imports and 10% on goods from China, demanding they curb the flow of fentanyl and illegal immigrants into the U.S.

February 3 – Trump agrees to a 30-day pause in his tariff threat on Mexico and Canada in return for concessions on border and crime enforcement. The U.S. does not reach such a deal with China.

February 10 – Trump raises tariffs on steel and aluminium to a flat 25%.

March 3 – Trump says 25% tariffs on goods from Mexico and Canada will take effect from March 4 and doubles fentanyl-related tariffs on all Chinese imports to 20%.

March 6 – Trump exempts goods from Canada and Mexico under a North American trade pact for a month.

March 26 – Trump unveils a 25% tariff on imported cars and light trucks.

April 2 – Trump announces global tariffs with a baseline of 10% across all imports and significantly higher duties on some countries.

April 9 – Trump pauses most of his country-specific tariffs that kicked in less than 24 hours earlier. The 10% blanket duty on almost all U.S. imports stays in place.

Trump says he will raise the tariff on Chinese imports to 125% from the 104% level that took effect a day earlier, pushing the extra duties on Chinese goods to 145%.

May 9 – Trump and British Prime Minister Keir Starmer announce a limited bilateral trade agreement that leaves in place 10% tariffs on British exports and lowers duties on British car exports.

May 12 – The U.S. and China agree to temporarily slash tariffs. Under the 90-day truce, the U.S. will cut the extra tariffs it imposed on Chinese imports to 30%, while China’s duties on U.S. imports will be slashed to 10% from 125%.

May 23 – Trump warns Apple AAPL.O it would face a 25% tariff if phones it sold in the U.S. were manufactured outside of the country.

May 29 – A federal appeals court temporarily reinstates the most sweeping of Trump’s tariffs, pausing an earlier lower court’s ruling to consider the government’s appeal.

June 3 – Trump signs an executive proclamation activating a hike in the steel and aluminium tariffs to 50%.

July 3 – Trump says the U.S. will place a 20% tariff on many Vietnamese exports, with trans-shipments from third countries through Vietnam facing a 40% levy.

July 7 – Trump says on Truth Social the additional higher duties announced previously will kick in on August 1. In letters sent to 14 countries, he says that will include tariffs between 25% and 40%.

July 10 – Trump says the U.S. will impose a 35% tariff on imports from Canada in August and plans to impose blanket tariffs of 15% or 20% on most other trading partners.

July 15 – Trump says the U.S. will impose a 19% tariff on goods from Indonesia under a new agreement.

July 22 – Trump strikes a trade deal with Japan that includes lowering tariffs on auto imports to 15%.

July 27 – The U.S. reaches a trade agreement with the European Union, imposing a 15% import tariff on most EU goods.

July 30 – Trump says the U.S. will impose a 25% tariff on goods imported from India, and places a 50% tariff on most Brazilian goods, with softer quotas for sectors such as aircraft, energy and orange juice.

The U.S. reaches a deal with South Korea, reducing the planned levies to 15%.

Trump says a 50% tariff on copper pipes and wiring would also kick in on August 1.

July 31 – Trump signs an executive order imposing import tariffs ranging from 10% to 41% on 69 trading partners ahead of the trade deal deadline.

He issues a separate order raising duties on Canadian goods subject to fentanyl-related tariffs to 35%, from 25% previously.

He grants Mexico a 90-day reprieve from higher tariffs of 30% on many goods to allow time to negotiate a broader trade pact.

August 6 – Trump imposes an additional 25% tariff on goods from India, saying the country directly or indirectly imported Russian oil.

August 7 – Trump’s higher tariffs on imports from dozens of countries kick in, leaving major trade partners such as Switzerland, Brazil and India searching for a better deal.

August 11 – Trump extends tariff truce with China for another 90 days, withholding imposition of three-digit duties until November 10. China’s Commerce Ministry issues a parallel pause on extra tariffs.

August 21 – The U.S. and EU administrations lock in a framework trade deal that set the duties at 15% on most goods imported from Europe.

Additionally, Washington pledged to reduce the current 27.5% levy on cars and car parts, provided Brussels delivers on tariffs cuts on U.S. goods.

September 25 – Trump unveils tariffs on a broad range of goods, including 100% duties on branded drugs and 25% tariffs on heavy-duty trucks. All the new duties will take effect from October 1.

Akazawa declined to comment directly on the new measures, adding Tokyo was still assessing how they related to their existing deal.

In Australia, Health Minister Mark Butler told reporters the government was working to understand the implications of the new “unfair, unjustified tariffs after 20 years of free trade.”

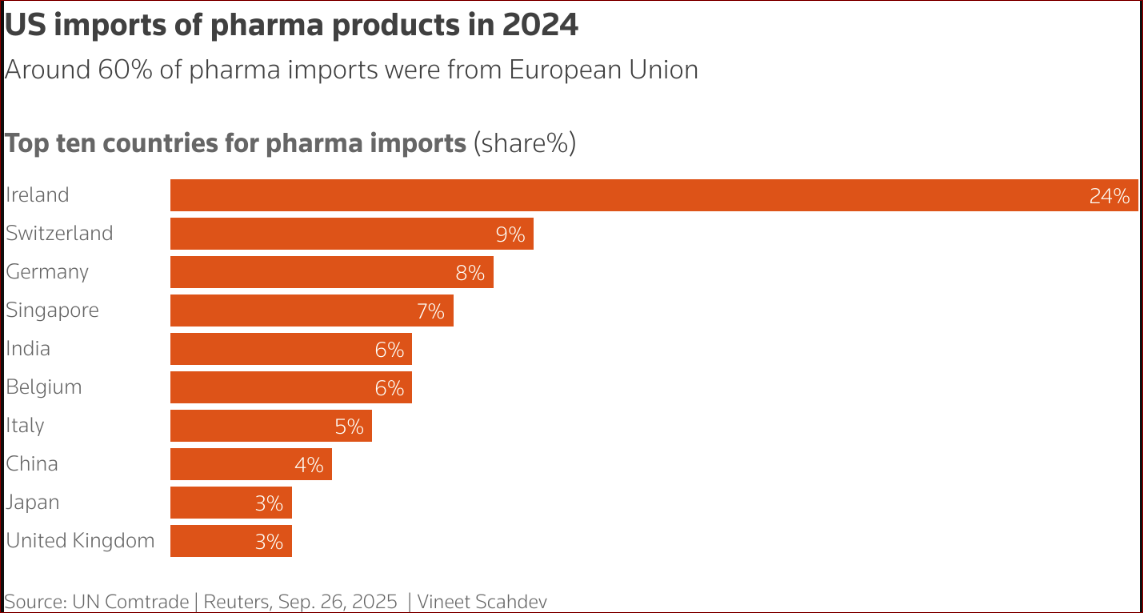

More than half of the $85.6 billion in ingredients used in medicines consumed in the United States are manufactured in the U.S., with the remainder from Europe and other U.S. allies, the U.S. pharmaceutical trade group said earlier this year.

When it comes to furniture, imports to the United States hit $25.5 billion in 2024, up 7% from the year prior. About 60% of those imports came from Vietnam and China, according to Furniture Today, a trade publication.

“Many of our members were shocked when we heard the news. I think the decision on the additional tariff is unfair,” said Nguyen Thi Thu Hoai from the Wood and Handicraft Association of Dong Nai province, one of Vietnam’s largest furniture clusters.

Trump in August had promised to impose new furniture tariffs, saying it “will bring the Furniture Business back” to North Carolina, South Carolina and Michigan.

Furniture and wood products manufacturing employment in the U.S. has halved since 2000 to around 340,000 today, according to government statistics.

INFLATION PRESSURE

Higher tariffs on commercial vehicles could put pressure on transportation costs just as Trump has vowed to reduce inflation, especially on consumer goods such as groceries.

Trump said the new heavy-duty truck tariffs were to protect manufacturers from “unfair outside competition” and said the move would benefit companies such as Paccar-owned PCAR.O Peterbilt and Kenworth and Daimler Truck-owned DTGGe.DE Freightliner.

The U.S. Chamber of Commerce earlier urged the department not to impose new truck tariffs, noting the top five import sources are Mexico, Canada, Japan, Germany, and Finland “all of which are allies or close partners of the United States posing no threat to U.S. national security.”

Mexico, the largest truck exporter, has opposed new tariffs, telling the Commerce Department in May that all Mexican trucks exported to the United States have on average 50% U.S. content, including diesel engines. Chrysler-parent Stellantis STLAM.MI is among many companies that produces trucks in Mexico.

Last year, the United States imported almost $128 billion in heavy vehicle parts from Mexico, accounting for approximately 28% of total U.S. imports in the category, Mexico

No comments

Thanks for viewing, your comments are appreciated.

Disclaimer: Comments on this blog are NOT posted by Olomo TIMES, Readers are SOLELY responsible for their comments.

Need to contact us for gossips, news reports, adverts or anything?

Email us on; olomoinfo@gmail.com